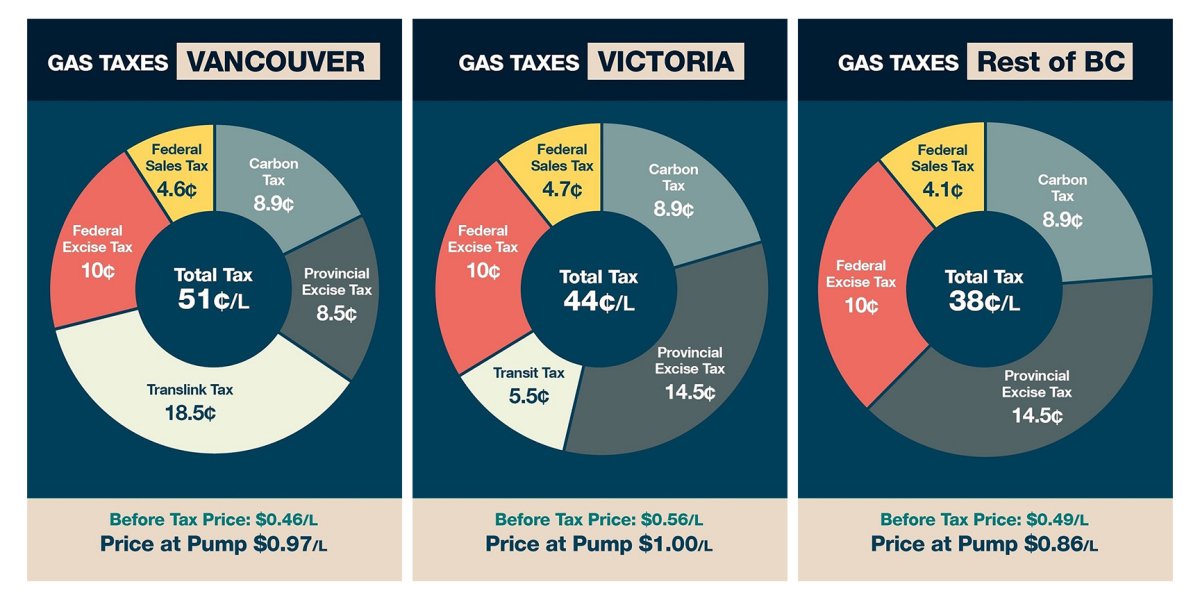

Fuel Tax Credits 2025 Canada. That’s why t here are over 400 deductions and credits that the cra outlines. Check the fuel tax credit rates from 1 july 2025 to 30 june 2025 for business.

When it comes to taxes, there’s no one size fits all scenario. It has committed to being carbon negative by 2030, but its emissions have skyrocketed more than 40% since 2025, thanks in part to its booming ai.

New Tax Credits For 2025 Canada Kare Sandra, Eligibility, including the continuation of eligibility, remains at the discretion of transport canada.

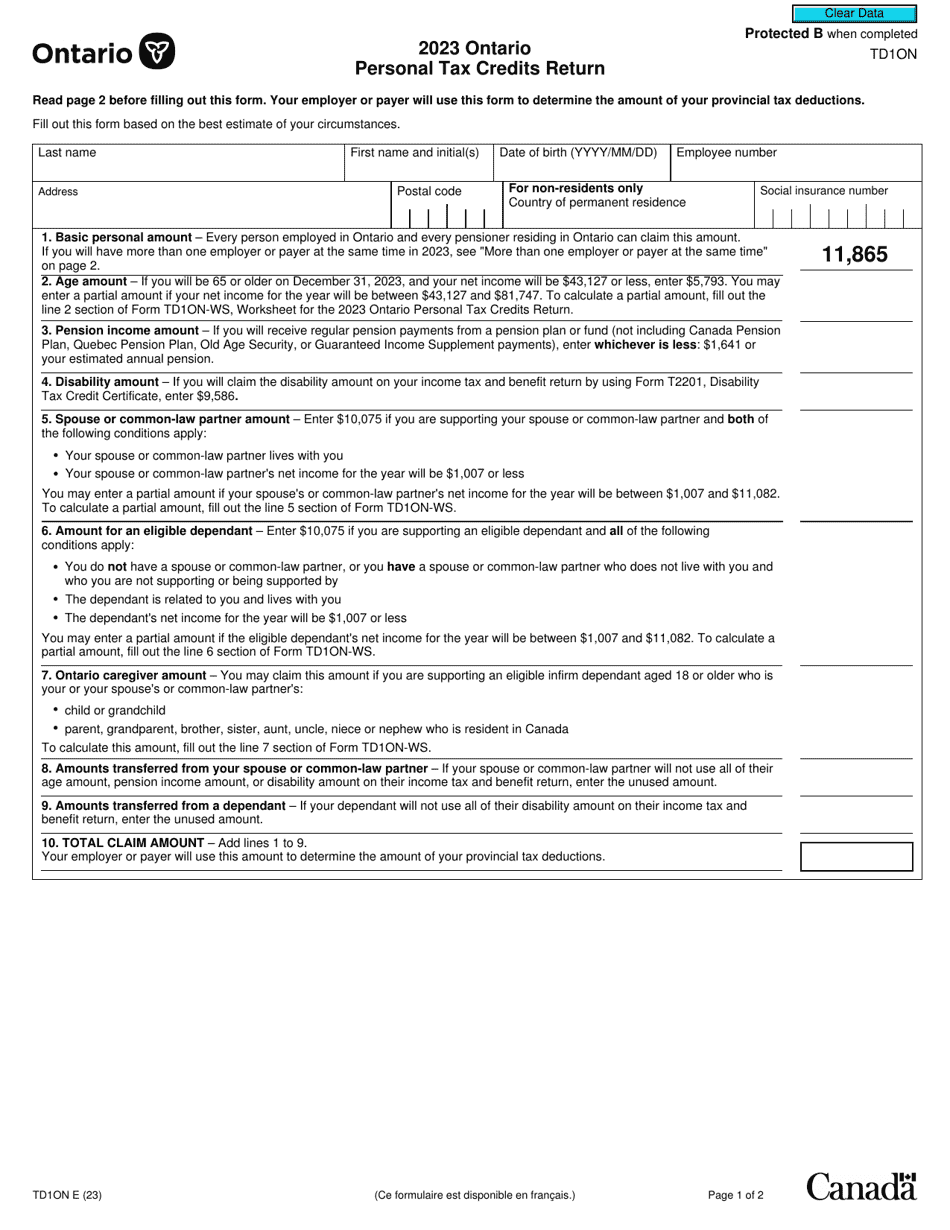

7500 Canada Tax Credit 2025 Approved, Know Payment Date & Eligibility, The canada carbon rebate for small businesses is a refundable tax credit announced in budget 2025 to return a portion of federal fuel charge proceeds directly to.

Fuel Tax Credits 2025 Calculator Johna Babette, A global pathway to keep the 1.5 °c goal in reach.

Canadian Taxpayers Federation releases annual gas tax report Okanagan, A fuel charge year runs from april 1 to march 31.

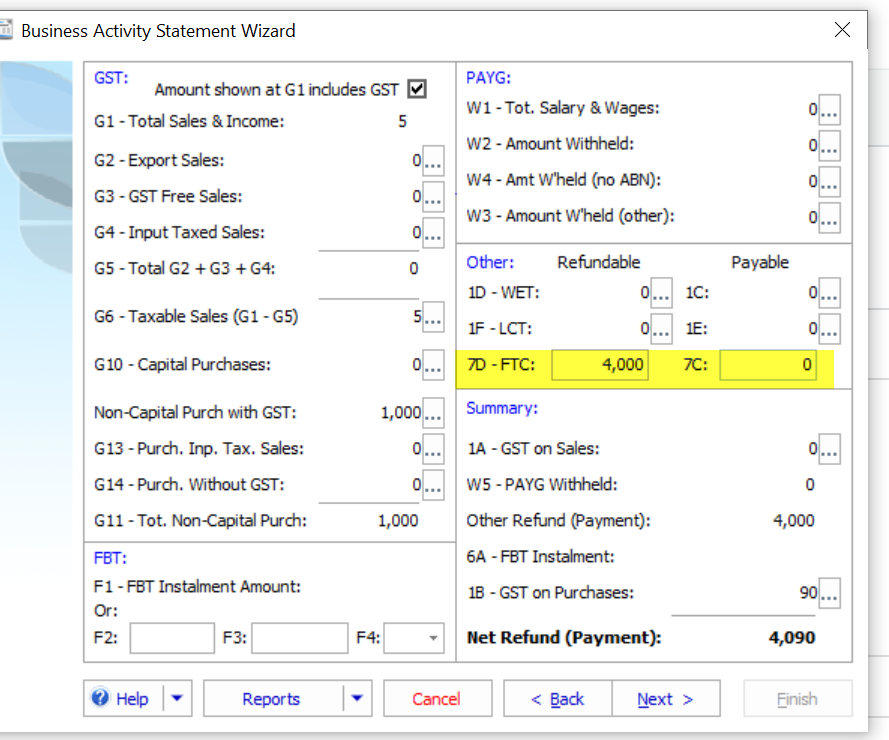

Fuel Tax Credits Sand & Stone, As part of this initiative, the government is offering various refundable investment tax credits (itcs) to canadian businesses exploring opportunities to invest in clean energy in.

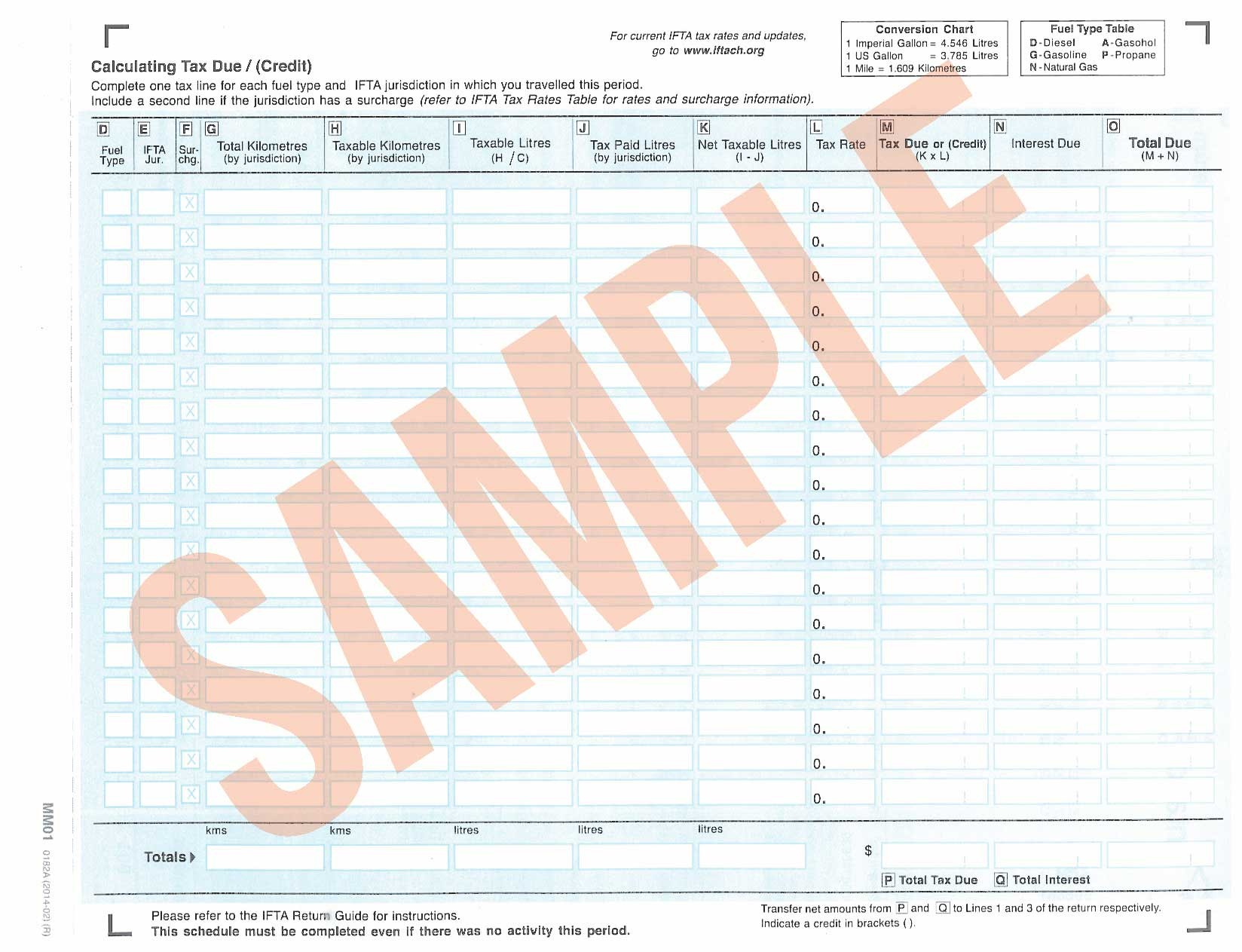

Changes to fuel tax credit rates Paris Financial Accounting And, Stock decreased by 0.3% to $11.07.